24,5 % Performance

KEY FIGURES

Purchase Price Q2 2018: EUR 15'000'000

Sales Price Q1 2020: EUR 25'530'000

Perfomance – IRR: 24.5% p.a.

Value Add Strategy

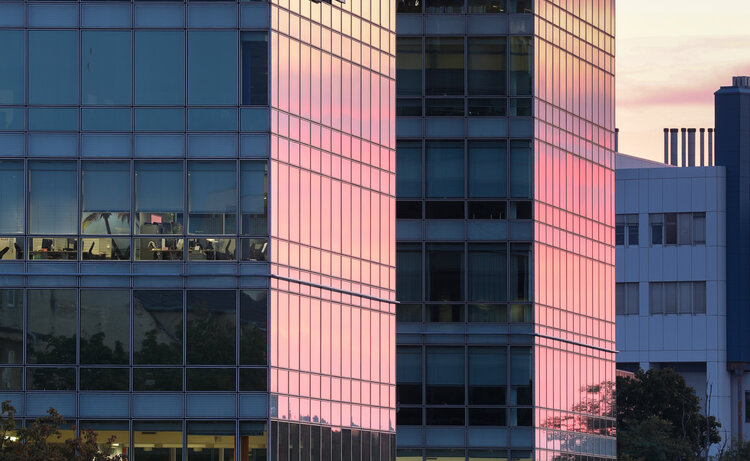

The property was acquired as an undermanaged property with excellent value add potential. The location in the south of Dusseldorf, close to Cologne and Leverkusen has been growing significantly in recent years.

The property generated a preferable return at medium risk. Thanks to Capex implementation and active leasing activities we were able to lease up 12% vacancy within 15 months and extend existing lease agreements.

24,5 % Performance

KEY FIGURES

Purchase Price Q2 2018: EUR 15'000'000

Sales Price Q1 2020: EUR 25'530'000

Perfomance – IRR: 24.5% p.a.

17,8% Performance

KEY FIGURES

Purchase Price Q1 2014: EUR 48’750’000

Sales Price Q2 2018: EUR 63’300’000

Perfomance – IRR: 17.8% p.a.

Average Distribution (before sale): 9.92% p.a.

Core Strategy

The property was acquired in Q1 2014 with a strong single-tenant, under contract with a 10 year lease. Constructed in 2002, the state-of-the-art office building with a total lettable area of 19’977sqm, is located in Frankfurt’s submarket Eschborn, a popular business location with lower trade tax rates and rent levels than the neighbouring Frankfurt. Compared to the rising prices of Frankfurt's hub market, the low rent in Eschborn offers an extremely attractive office location for many businesses.

Thanks to the double-net rental agreement and the tenant’s desire to maintain the property as their representative headquarters, it was possible to manage the property very cost efficiently. The long-term lease and the tenants’ high level of investment in the technical specification of the building further underlined their commitment to the property.

At the same time, the building has the potential to easily be converted into a multi-tenant office building, thanks to its unique construction and structure, therefore presenting a fallback scenario in case of a non-performance of the tenant.

Due to BlueRock’s excellent management, the sale in 2018 resulted in a highly profitable investment return for investors. The bank financing, optimized tax structure and the active tenant management were the main drivers behind this successful transaction.

*BlueRock Fund Cell E Techem is closed for new investments.

17,8% Performance

KEY FIGURES

Purchase Price Q1 2014: EUR 48’750’000

Sales Price Q2 2018: EUR 63’300’000

Perfomance – IRR: 17.8% p.a.

Average Distribution (before sale): 9.92% p.a.

![[Translate to Englisch:] [Translate to Englisch:]](/fileadmin/_processed_/a/e/csm_Einsiedeln_5ff9df451b.jpg)

![[Translate to Englisch:] [Translate to Englisch:]](/fileadmin/_processed_/7/4/csm_ae626057-a1ef-4924-82b6-abf127533fb0_2c56db76b7.jpg)

![[Translate to Englisch:] [Translate to Englisch:]](/fileadmin/_processed_/e/d/csm_DJI_0001_8cb9838507.jpg)

read more

read more